I can vividly remember, as a young lad, my dad sitting at the kitchen table paying the monthly bills by check and then updating his checkbook. I remember asking him why he entered the details on the page at the back of the checkbook. He said very clearly, “So we don’t spend more than we have and in the bank. If I don’t keep track, we will run out of money and I’ll end up bouncing a check!”

In hospitality, we are all much better off when we use the checkbook system to manage our expenses so we don’t run out, and so we don’t overspend. The only difference between my dad and your department’s expenses is you do not really run out of money like he could, you just go over your budget or forecast. This usually results in some frustration, perhaps even a nasty email or two. The great thing about this situation is it easily can be rectified with a little work on your part. Having and using a checkbook is a great way to get and stay on top of your departmental expenses. Do this and your star is shining.

Contrary to common belief a useful and accurate checkbook does not require a computer system and, in many cases, it is much easier to use one without all the hoopla that an online environment creates. All you need is a piece of paper, or better still your trusty Excel sheet.

The basic idea about a checkbook is to tell the user what the final position is with your line-by-line expenses and exactly where you are on that path. Specifically, what have you ordered (approved and ordered purchases orders), what has been received (what goods that were received that have invoices or packing slips that were signed and sent to accounts payable), and, finally, what was received that did not have an invoice or packing slip (items that need to be accrued at month-end, items that need to be added to the expenses).

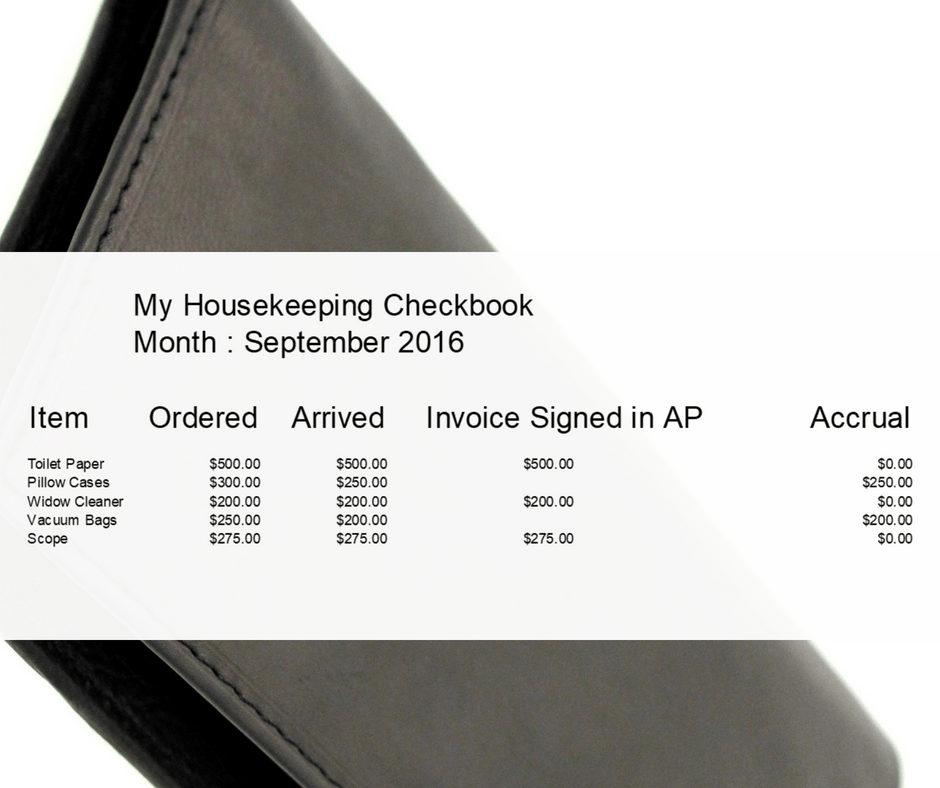

That’s it—a shortlist—it should look like this:

The checkbook must be organized so you have a different list (page) for each general ledger account you are responsible for, e.g., guest supplies, cleaning supplies, paper goods, etc.

The first thing to do is make a separate page for each account and put a title on it. Next, populate each sheet with the items you will need to order. Here is where most people tune out, but not you. If you are not sure what to write for the items you need to order then do the following: Write down the items you think you need and as the month starts and you order additional items, write those down on the correct page. If you do this, your list by account will come together very quickly. When you make an order, be sure to write the dollar amount in the “ordered” column. Tip: Add the quantity to the items column with the description. This will be a great help next month.

Once the order has been placed, the next step is to simply wait for the items to arrive. When they do you enter the dollar amount in the “arrived” column. Normally, items arrive with an invoice or packing slip. Make sure you see this and sign it, and I also recommend you make a photocopy for your records. The signed slip will either go to the receiving department or it will be your job to get it to the accounts payable person. When this happens you write the amount of the goods received into the “invoice signed” column. If you do this for all the items you order and do the same for any services you order, you have a full checkbook of the items ordered, received and approved for payment.

The last step is to accrue any items received that did not have an invoice or a packing slip. All you are doing with the accrual is telling the accounting department that these goods or services were received in the current month and no invoice was received. Using this information, the accounting department will bring these expenses into the current accounting period.

Now that you have one month under your belt you are away to the races. You now have a base for all your expense lines. You now know where things go—into which account—and how much you spent. From this point forward, each month you add to your knowledge and accuracy. Do not worry about missing items especially in the beginning, just start and pull your list together.

This is the hardest part—the beginning. Remember the golden rule about budgeting and forecasting: The only thing we know for sure is the number we come up with is wrong. That is right. Your forecast will never be perfect. It is always going to be a work in progress but knowing what you ordered, what has come in and what you have signed off on is career gold. You will very quickly organize your departmental expenses and make a name for yourself with the people who can tell the world in your hotel that you have your “$%#@” together.

This is what you want, not the chaos that comes from not knowing what is in your expenses. Do not be the one who misses this opportunity to shine.

Be the leader who has and uses their hospitality financial leadership skills.

Are you a leader on the move? Are you looking for a way to improve your hotel financial leadership skills? Give me a call or send me an email to connect and let’s discuss how I can help you with a 1-1 coaching package tailored just for you. It’s the fast lane to greater career success and your own personal prosperity.

Are you thinking about your management team and what to engage them with this year? Consider a half day hospitality financial leadership workshop.

Do you need a dynamic “hotel” speaker with a unique and creative financial leadership message for your next event?

Call or write today and arrange for a complimentary discussion on how you can create more profits in your hotel by working with me.

Give the coach a call today and let’s get going!

If you would like a copy of any of the following send me an email at

- RevPar Index Spreadsheet

- Incentive Plan Template

- EFTE and Productivity Exercise

- Hotel Financial Policy Manual – Inventory of “Sections”

- Hotel Financial Coach “Services Sheet”

- A White Paper – Creating a Hotel Policy Manual

- F&B Productivity Spreadsheet

- Rooms Productivity Spreadsheet

- Financial Leadership Recipe F TAR W

- A White Paper – A Six Month Workshop and Coaching Assignment

- Hotel Financial Coach – “Speaking Sheet”

- Flow Thru Cheat Sheet – Enhanced

Visit my website today for a copy of my FREE guidebook

The Seven Secrets to Create a Financially Engaged Leadership Team in Your Hotel

www.hotelfinancialcoach.com