If you only use RevPAR index, then you are missing the bulk of the story

From time immemorial, revenue per available room, or RevPAR, has been the go-to key performance indicator in the hotel industry. A simple calculation of average daily rate and occupancy rate, it is often thought of as the barometer of health for a hotel by those who work in the industry and those who make a living analyzing it.

Right or wrong, it has obtained monolithic stature. Is it time for it to be shattered?

Most scholarly studies note limitations in the research. These are weaknesses within a research design that may influence outcomes and conclusions of the research itself. This could be due to the sample size or an array of other shortcomings.

When looking at the totality of a hotel, RevPAR has its limits. Why? For one, and most glaring, it only measures revenue derived from rooms. And though room sales are the greatest source of revenue for a hotel, it is not the only avenue of income.

Though select-service hotels rely almost exclusively on room sales, with a smaller amount of ancillary revenue, full-service hotels have multiple income streams beyond rooms: food and beverage, conference and banqueting, spa/gym, golf, parking, dry cleaning services and more.

As the hotel industry drives the recovery forward, understanding and getting a firm hold on profitability has never been more essential. And it is why a focus on gross operating profit per available room, or GOPPAR, is the one key performance indicator that delivers that insight and why RevPAR just does not always cut it.

What is GOPPAR and Why It Matters

GOPPAR measures how much “operating profit” in dollars is being made from each room available in a hotel. An an index, it expresses how well an asset is being yielded relative to its competitive set of hotels. Creating the index is straightforward and defining the components of the index, in order to better understand the results and the opportunities, is the crux of this piece.

No discussion of GOPPAR can be had without a nod to its close sibling, RevPAR, a simple equation that combines occupancy percentage and average rate (for example: 75% occupancy x $200 average rate = $150 RevPar). The RevPar index is a measurement of how much room revenue a hotel is producing relative to the defined competitive set of hotels within a market. In other words, how big is its slice of the pie – given its size – compared to what it should be (e.g., number of rooms)?

In order to bring this analysis to life, I used real data from 2019 provided by global profit and loss data company, HotStats, a leader in revenue and expense insight.

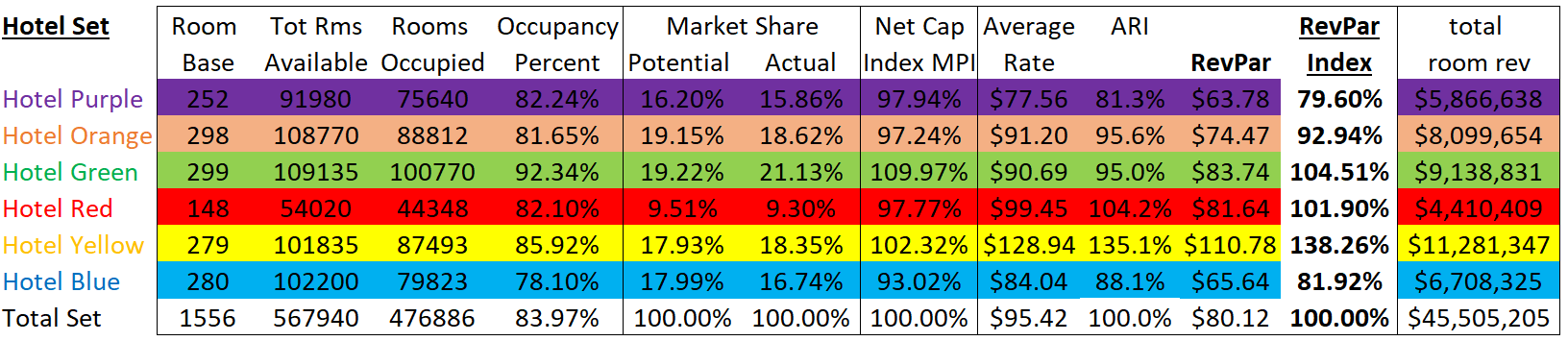

In sum, the characteristics of RevPAR index are relative size, multiplied by occupancy percentage (MPI) and average rate (ARI). The above chart shows Hotel Yellow as the leader and Hotel Purple as the poorest performer. With the RevPar index, the MPI and the ARI complete the entire picture of current performance and it also points to what is possible with the other assets in the marketplace if their performance changes due to a better sales effort, a renovation, or another brand flag, for example.

RevPAR index is great if you are only focused on rooms revenue. That is before other revenue is taken into consideration and before expenses are considered. In that regard, RevPAR index becomes a narrower way to judge a hotel’s performance. It would be like judging how good a football team is by the number of touchdowns it scores, not taking into account how many it gives up.

With GOPPAR we have a much more complete picture. GOP is the product of all revenues less all operating expenses. Hotels have multiple sources of revenue and three types of operating expenses: cost of goods, payroll and other expenses. The mix of room revenue versus F&B revenue versus minor operating income versus other income is also a sizeable consideration.

To better compare results, we need to be able to see what components are performing well or need improvement—something a company like HotStats allows for through comp set profit benchmarking.

In the diamond world, the value of a diamond is determined using the 4 Cs: carat, color, cut and clarity. Like gems, a hotel’s value can be measured by multiple characteristics beyond a multiple of current cash flow or its cap rate. By looking at the components of GOPPAR we can determine a hotel’s profitability and overall real value. With hotel profitability data at our fingertips, this is now possible. Here are eight components and how we should look at them:

- RevPar – Room revenue per available room. It is laid out above in an index and would look like $125 and 101% and include MPI and ARI.

- F&BRPAR – Total F&B revenue per available room. Dollars generated per available room, plus an index and a percentage of total revenue for comparison.

- ORPAR – Total Other revenues per available room. All other hotel revenue including minor ops, rents and commissions. Dollars generated per available room, plus an index and a percentage of total revenue for comparison.

- TRevPar – Total hotel revenue per available room. Dollars generated per available room and an index.

- Total Payroll % of Total Revenue – Total payroll including all benefits and supplemental costs expressed as a percentage of total hotel revenue and a cost per available room.

- Total Expenses % of Total Revenue – Total operating expense expressed as a percentage of total hotel revenue and a cost per available room.

- Cost of Goods % of Total Revenue – Total Cost of Goods Sold (F&B & MOD) expressed as a percentage of total hotel revenue.

- GOPPAR – Gross operating profit per room available expressed as a dollar amount, an index, and a percentage, plus GOP dollars per key.

The composition of all revenues and expenses leads up to hotel GOP. Each index and ratio, then, is compared to the other comp set hotels. This is not perfect and succinct, like MPI and ARI, because hotels have diverse offerings that do not always follow their relative size, such as larger than usual F&B offerings, meeting facilities, spas, golf courses, etc. This is a limitation on the comparison, and it points to ensuring the competitive set of hotels is relative based on their comparable offerings as much as possible.

We can group these into three sections for ease of viewing: pricing, costs and profits, and variances.

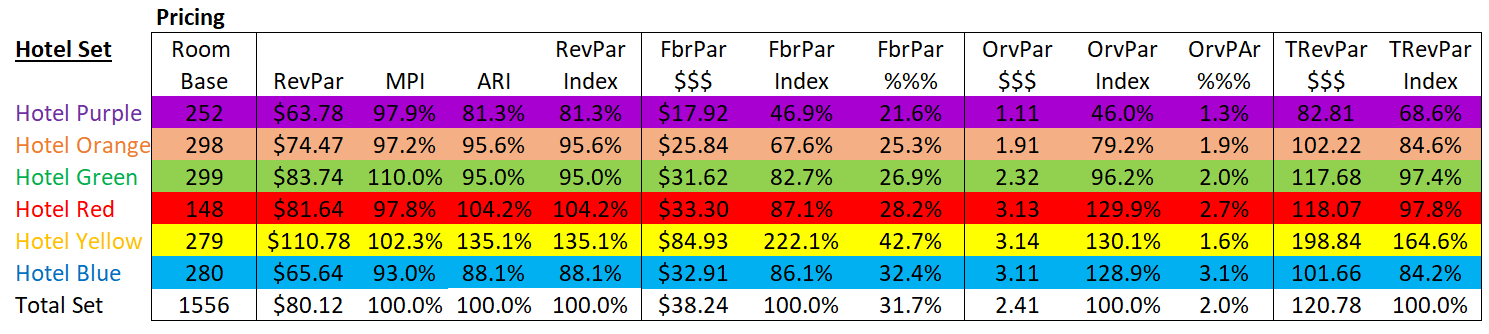

With pricing, we are looking at rooms RevPar, F&B RevPAR, all other revenues combined and TRevPar. Hotel Yellow has command of both the RevPar and the F&B measures and, from a revenue perspective, it is well ahead of the competition. Hotel Purple and Hotel Blue are the worst-performing RevPar hotels and Hotel Orange has a poor TRevPar showing, a function of an especially poor F&B result. The other hotels, Green Red and Blue, all have positive indexes.

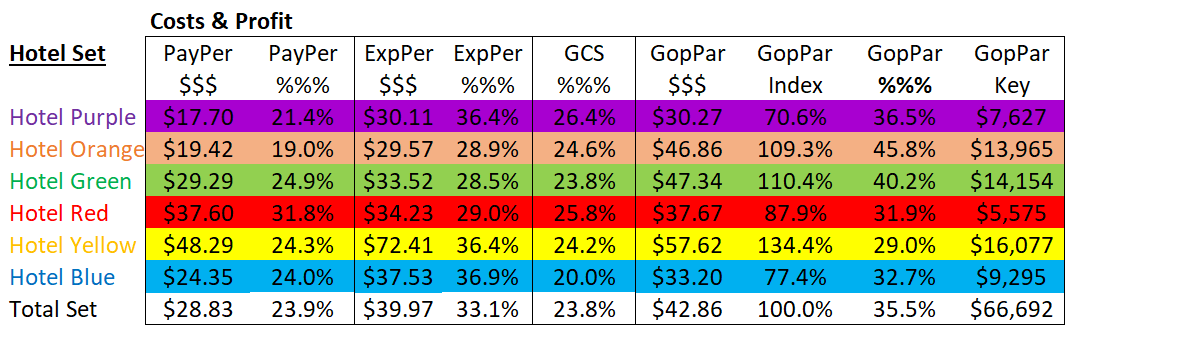

Costs and profit reveal interesting changes from the pricing picture. Though Hotel Yellow has the lead in GOPPAR index, other remarkably interesting changes in the other hotels have emerged. Hotel Orange and Green have moved into a solid positive index position and when we measure GOPPAR they are remarkably close to the performance of Hotel Yellow. This has been achieved by quite different cost structures. Hotel Yellow spent a combined $120 per available room in pay and expenses while Hotel Orange and Hotel Green got by at $49 and $62, respectively. Revenue, in Hotel Yellow’s case, does not always equate into better profitability.

Meanwhile, the other hotels in the set – Red and Blue – each show a significant decline in GOPPAR index, compared to RevPar and TRevPar, pointing to their heftier cost structure.

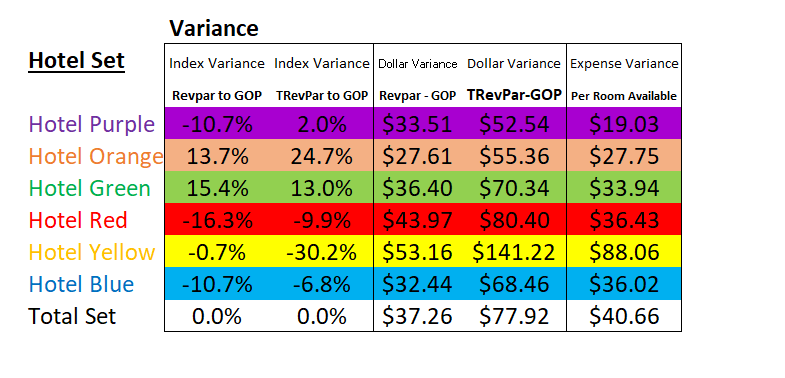

Now, let’s look at the index variances above.

First, we compare the RevPar index to the GOPPAR index, which demonstrates the increase or decrease in the GOP index relative to the starting point, RevPar. Here we see that Hotel Orange and Hotel Green have used their operating prowess to reverse the RevPar results, creating a positive GOP movement relative to their competitive set. Hotels Purple, Red and Blue lose ground at GOP relative to their RevPar starting points. Hotel Yellow is flat with no change.

Next, we want to compare the effects of other revenues that are included in the TRevPar index to the GOPPAR index. We know the lion’s share of hotel GOP comes from room revenues and that mix creates efficiency when it is tilted toward rooms. The opposite is likely when the subject hotel has larger F&B and other revenues. Here we see the impact of the other additional revenues on GOP performance. This is where the tide turns. Consider Hotel Yellow’s 30% decline in GOPPAR relative to the total revenue picture. On the flip side, the nimbler Hotel Orange and Hotel Green gain index because they are light on other revenues and the complementary carrying costs associated with these types of income.

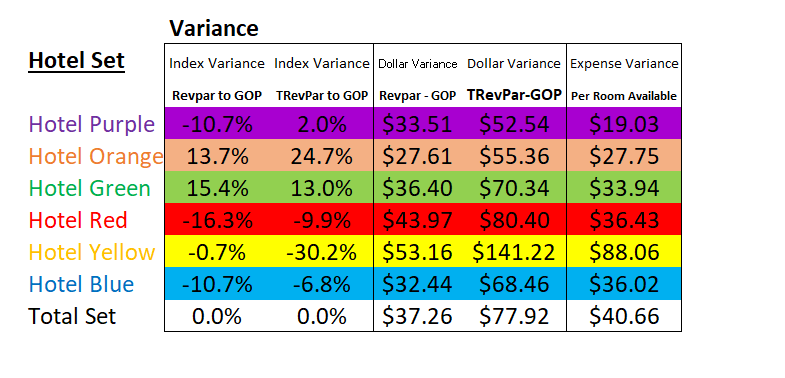

Now, let’s look at the dollar variances above.

RevPar less GOPPAR shows us the effects of the operating costs. Hotel Yellow lost the most at nearly double Hotel Orange’s impressive results and significantly more than all other hotels. Hotel Red also is being dragged down.

When we compare TRevPar less the GOPPAR, the results are amplified. Hotel Yellow consumed $141 per room available in operating expenses. Its TRevPar was $199 and its GOPPAR result was $58. This clearly points to Hotel Yellow being the least efficient property in flow-through, or the ability to convert revenue into profit. Conversely, Hotel Purple and Orange show their agility.

Finally, in the last column, we have a clear view of the total expense per room available. It shows us the dramatic variances in operating costs. Again, Hotel Yellow is leaps and bounds ahead, but it is obvious how out of shape it really is. Hotel Purple, on the other hand, can operate at a quarter of the cost per available room compared to Hotel Yellow.

Conclusion

This analysis brings up many questions:

- Should hotels have different comp sets for REVPAR compared to GOPPAR? In some cases, yes.

- How valuable is RevPar and TRevPar relative to performance compared to GOPPAR?

- When a hotel is valued, it is typically done on a multiple of cash flow at net operating profit. So, do we even care about what happens in the middle?

- Using Hotel Yellow as an example, it finished in the first place from a profit per key and all other GOP measures, so do the ends justify the means?

- Again, with Hotel Yellow, is there not a clear picture of poor performance in the middle leading us to the conclusion that they could do so much better?

Using the eight measurements above, we can get a noticeably clearer picture of where a hotel’s performance ranks compared to its competition. This analysis points to what is possible with a hotel’s performance within that marketplace—especially if considering an investment or a comparison of costs, which potentially can be better managed, resulting in better-yielding assets.

Owners know that hotels have their secrets well hidden, but maybe not for much longer.

At Hotel Financial Coach I help hotel leaders and teams with financial leadership coaching, webinars and workshops. Learning and applying the necessary financial leadership skills is the fast track to greater career success and increased personal prosperity. I significantly improve individual and team results with a proven return on investment.

Click on the image above to learn more about my video course.

Complimentary Discovery Call – https://hotelfinancialcoach.com//hotelfinancialcoach.com//calendly.com/hotelfinancialcoach/discovery

Be sure to check out my other services on the links below.

Stay at Home or Work – Online Workshops

The 3 Month 1-1 Financial Leadership Mentoring Program

Strategic Hospitality Financial Leadership Workshops

415 696 9593 – Cell or Text

Read a Story About How I Helped a Client

Give the coach a call today and let’s get going!

If you would like a copy of the following send me an email at

-

RevPar Index Spreadsheet

Visit my website today for a copy of my FREE guidebook

The Seven Secrets to Create a Financially Engaged Leadership Team in Your Hotel

www.hotelfinancialcoach.com